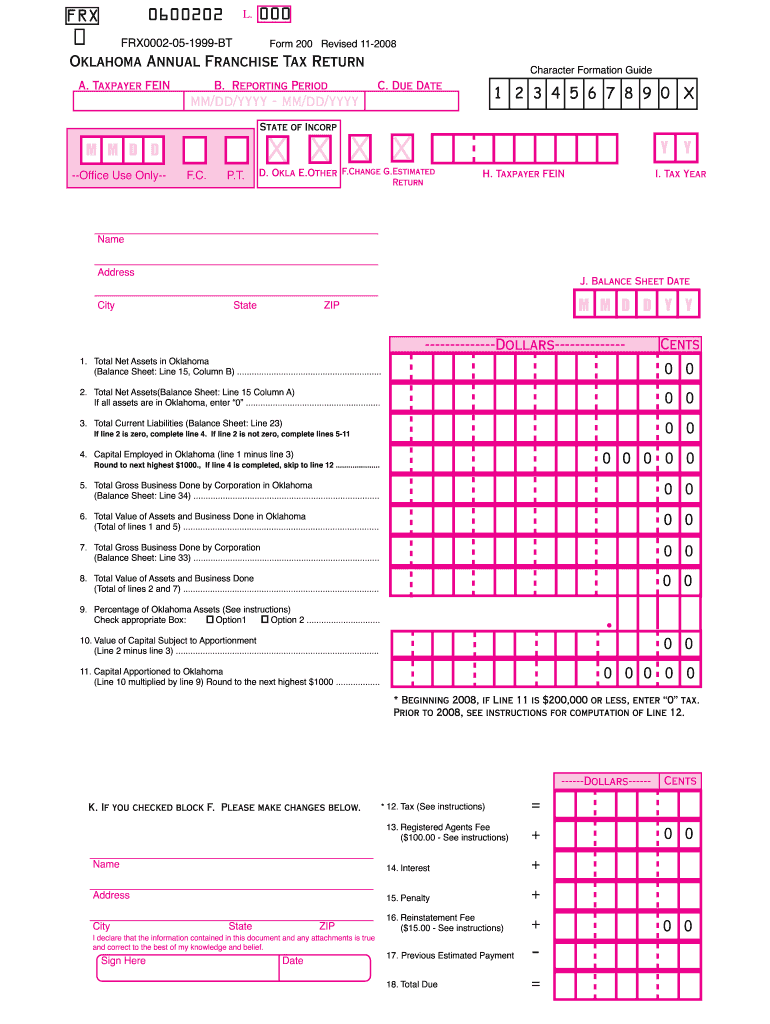

oklahoma franchise tax form

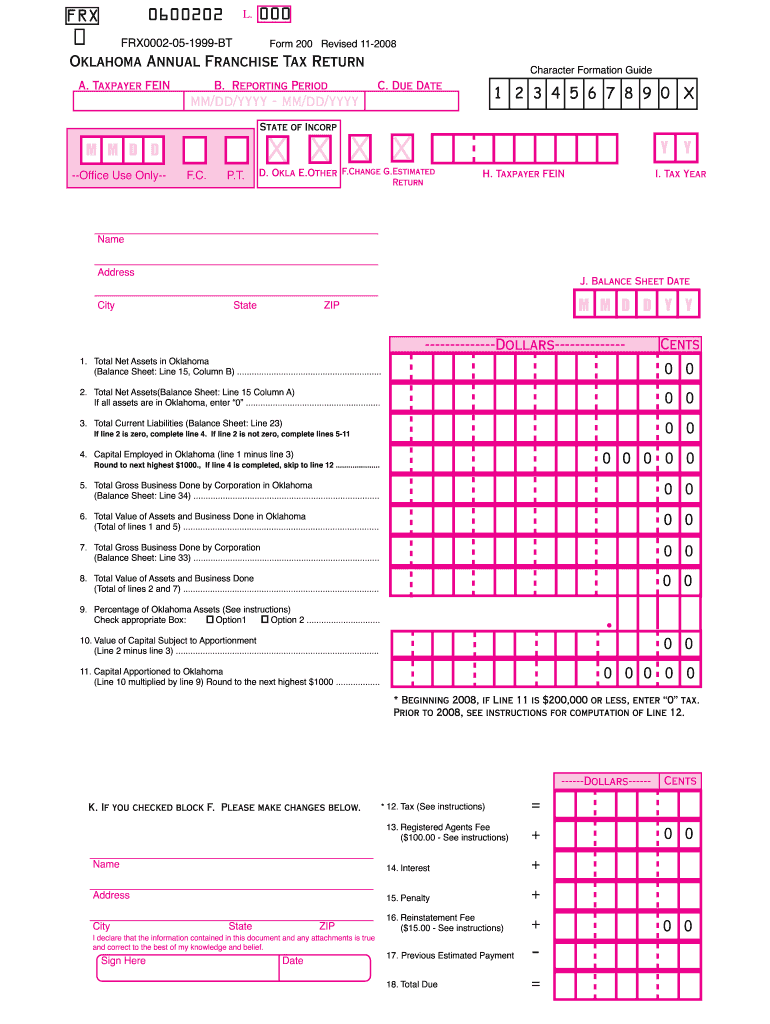

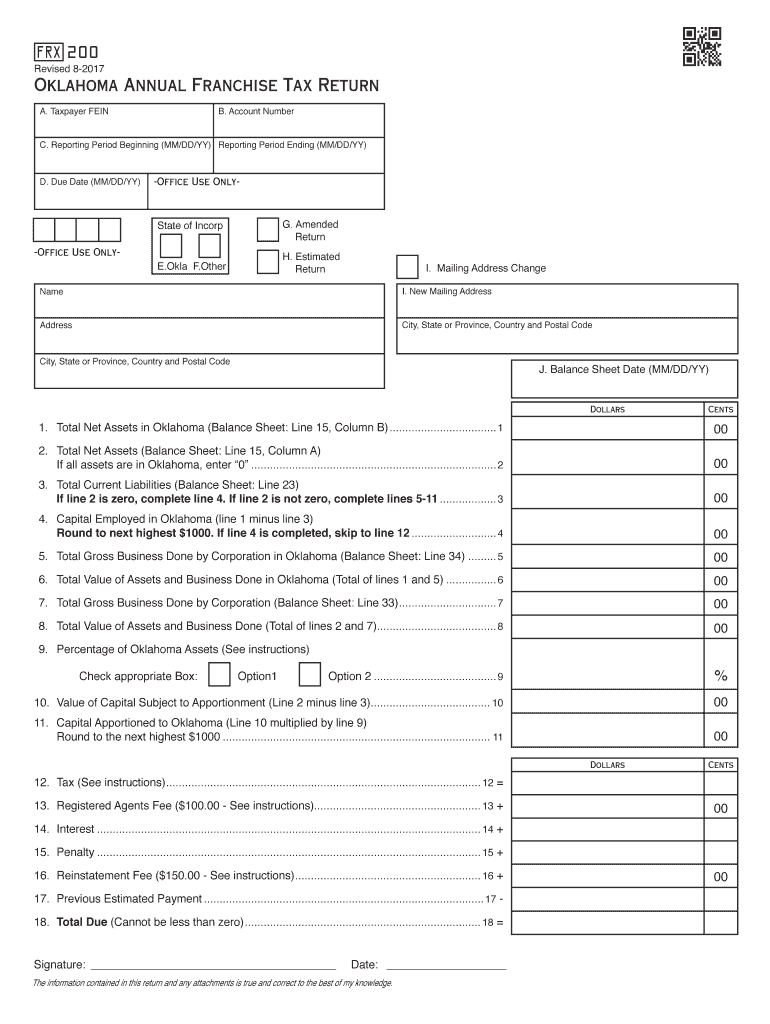

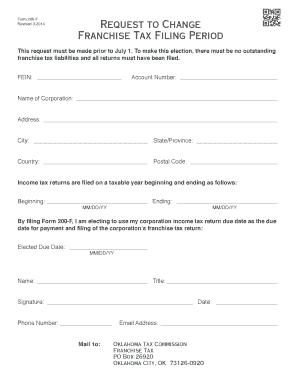

Change Franchise Tax Filing Period. Franchise Tax Computation The basis for.

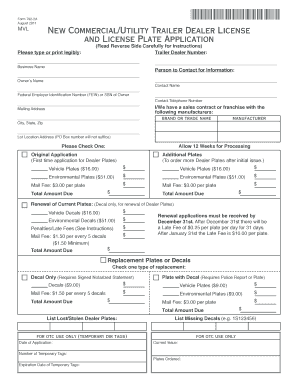

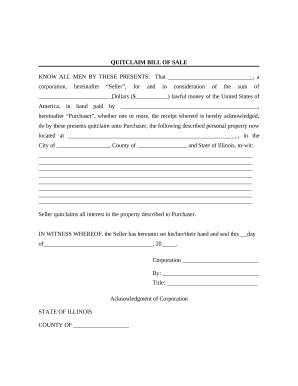

Fillable Online Tax Ok Utility Trailer Tax In Oklahoma Form Fax Email Print Pdffiller

Use Fill to complete blank online.

. Once completed you can sign your fillable form or send for signing. All organizations falling within the purview of the Franchise Tax Code. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F.

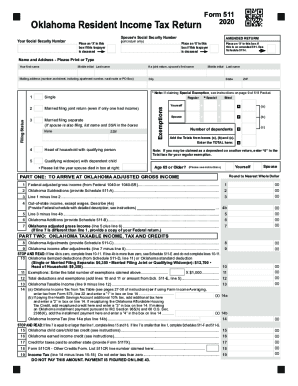

All forms are printable and downloadable. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax. Oklahoma Income Tax Forms at httpwwwtaxokgovitformcrt1html.

Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. Oklahoma franchise tax is due and payable each year on July 1. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Maximum filers should complete and file Form 200 including a schedule of current If a taxpayer computes the franchise tax due and determines that it amounts to 250. Forms - Business Taxes Forms - Income Tax Publications Exemption.

TaxFormFinder - One Stop Every Tax Form. Mine the amount of franchise tax due. Oklahoma Small Business Corporation Income and Franchise Tax Forms and Instructions.

When is franchise tax due. We last updated the Small Business Corporate Tax Return Packet form and instructions in. Download Oklahoma Annual Franchise Tax Return 200 Tax Commission Oklahoma form.

Oklahoma Tax Commission at httpwwwtaxokgov Form 512 is an Oklahoma Corporate Income Tax form. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F. Corporations not filing Form.

To make this election a corporation must use Form 200-F Oklahoma Tax Commission Franchise Election Form Form 200-F to notify the Oklahoma Tax Commission OTC of its election to. Franchise Tax Payment Options New Business Information New Business Workshop. Browse By State Alabama AL Alaska AK Arizona AZ.

You can download this form from the Oklahoma Tax Commission website wwwtaxokgov. For a corporation that has elected to change its filing period to match its fiscal year the franchise. Oklahoma Annual Franchise Tax Return State of.

To make this election file Form 200-F.

Oklahoma Tax Commission Form Frx200 Fill Out Sign Online Dochub

Oklahoma Tax Reform Options Guide Tax Foundation

Form An Oklahoma Professional Corporation Today Zenbusiness Inc

How To Start Your Llc In Oklahoma Tailor Brands

State Income Tax Extensions Weaver

511 Packet Instructions Oklahoma Resident Individual Income Tax Forms And Instructions Fill Out And Sign Printable Pdf Template Signnow

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

Oklahoma Tax Resolution Options For Back Taxes Owed

How To Form An Llc In Oklahoma Llc Filing Ok Swyft Filings

2007 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Oklahoma Tax Commission Form Frx200 Fill Out Sign Online Dochub

Oklahoma Proposes Phasing Out Corporate Income And Franchise Tax

Ok 200 Annual Franchise Tax Return 2008 Form Fill Out Sign Online Dochub

State Corporate Income Tax Rates And Brackets Tax Foundation

Fill Free Fillable Forms State Of Oklahoma

Form 200 F Fill And Sign Printable Template Online

Oklahoma Tax Deadline Extended Two Months

Fill Free Fillable Forms State Of Oklahoma

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller